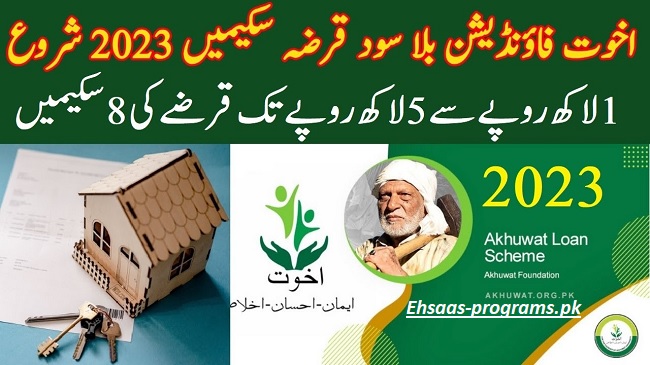

Akhuwat Loan Apply Online 2023-24 Interest Free Loan Scheme

Akhuwat Loan Foundation

The Akhuwat Loan Foundation is a non-profit organization and microfinance bank located in Pakistan. It was established in 2001 with the aim of reducing poverty and improving the lives of marginalized communities in the country. The foundation operates based on the principles of unity and equality, guided by the Islamic principle of Muwakhat, which means solidarity.

The main goal of the Akhuwat Loan Foundation is to provide interest-free loans to deserving individuals who are financially disadvantaged and do not have access to traditional banking services. The foundation focuses on supporting people with low incomes, aiming to empower them economically by offering interest-free loans for their educational expenses and various financial needs.

Through its financial program, the Akhuwat Loan Foundation assists individuals in starting or expanding their small businesses, acquiring education, accessing healthcare services, obtaining housing, and establishing welfare foundations. These loans are interest-free, adhering to Islamic principles that prohibit the charging or receiving of interest.

By providing interest-free loans, the Akhuwat Loan Foundation has become a catalyst for social and economic transformation in Pakistan. It plays a vital role in uplifting communities, helping individuals achieve financial independence, and fostering economic growth. Many people have achieved success in their endeavors through the support and opportunities provided by the foundation.

To effectively administer the loan scheme, the Akhuwat Loan Foundation collaborates with a microfinance bank. This partnership ensures the efficient delivery of loans and allows individuals to benefit from the foundation’s interest-free financing while complying with the regulatory requirements of the banking sector.

Overall, the Akhuwat Loan Foundation is a significant initiative in Pakistan that promotes financial inclusion and empowerment among underprivileged sections of society. Its mission to alleviate poverty and enhance lives demonstrates its dedication to principles of unity, equality, and social justice.

Types Of Akhuwat Loan Scheme 2023

Akhuwat Loans come in two different ways to help different people. These two types are Group Lending and Individual Lending.

Group Lending:

Group Lending means that a group of three to six people who live near each other but are not necessarily family, join together. In this group, each member guarantees the loans and trustworthiness of the others. So, if one person cannot repay their loan, the others in the group will step in and cover the payment. This system encourages everyone in the group to take responsibility for each other’s financial obligations and provides mutual support.

Individual Lending:

Individual Lending is for people who meet Akhuwat’s criteria. Under this type of loan, individuals can apply for money to fulfill their specific needs. To be eligible, the applicant needs to provide two people who can guarantee that they will repay the loan on time. These guarantors act as a promise to the lender that the loan will be paid back as agreed.

Also visit: 5 Lakh Loan Without Interest in Pakistan 2023 Kamyab Program

Akhuwat Loan Scheme Details – Interest-Free Loan

Akhuwat offers different types of loans with varying amounts, durations, and application fees. Here are the details:

Family Enterprise:

- Loan Amount Range: From PKR 10,000 to 50,000

- Duration: 10 to 36 Months

- Application Fee: PKR 200

Agriculture:

- Loan Amount Range: From PKR 10,000 to 50,000

- Duration: 04 to 08 Months

- Application Fee: Not specified

Liberation Loan:

- Loan Amount Range: From PKR 10,000 to 100,000

- Duration: 10 to 36 Months

- Application Fee: PKR 200

Akhuwat Housing Loan:

- Loan Amount Range: From PKR 30,000 to 100,000

- Duration: Up to 36 Months

- Application Fee: PKR 200

Education:

- Loan Amount Range: From PKR 10,000 to 50,000

- Duration: 10 to 24 Months

- Application Fee: PKR 200

Health:

- Loan Amount Range: From PKR 10,000 to 50,000

- Duration: 10 to 24 Months

- Application Fee: PKR 200

Marriage:

- Loan Amount Range: From PKR 10,000 to 50,000

- Duration: 10 to 24 Months

- Application Fee: PKR 200

Emergency:

- Loan Amount Range: From PKR 10,000 to 50,000

- Duration: 10 to 24 Months

- Application Fee: PKR 200

Equipment and Build School:

- Loan Amount Range: From PKR 25,000 to 150,000

- Duration: Up to 36 Months

- Application Fee: PKR 200

These loans are designed to fulfill various needs such as starting a family enterprise, agricultural expenses, liberation, housing, education, health-related expenses, marriage, emergencies, and school equipment or construction. The loan amounts differ depending on the type of loan, and the repayment duration ranges from a few months to up to 36 months. For most loan types, there is an application fee of PKR 200.

Eligibility Criteria for Applying for Akhuwat Loans

To be eligible for an Akhuwat loan, there are certain criteria you need to meet. These criteria include the following steps:

Identity Proof:

- You need to provide a valid identity card as proof of your identity.

Residential Area:

- You should reside within a distance of two and a half kilometers from an Akhuwat Microfinance Bank branch.

Age Requirement:

- Your age should be between 18 and 62 years.

Guarantor Details:

- You should be able to provide the contact information and bank details of two non-family members who can act as your guarantors.

Good Moral Character:

- It is important to have a positive reputation and good social standing in your community.

No Criminal Involvement:

- You should not be engaged in any criminal activities or have any criminal cases pending against you.

Character Certificate:

- It is necessary to provide a character certificate from the police or relevant authorities to demonstrate your good character and reputation.

Meeting these eligibility criteria will increase your chances of qualifying for an Akhuwat loan.

Also visit: Prime Minister Youth Loan Scheme 2023 Online Apply Pakistan

Required Documents

To apply for an Akhuwat loan, you will need to provide the following documents:

Copies of CNIC:

- Applicant (Must have)

- Guarantors (Must have)

- Family Member (Optional)

- These documents are needed for identification purposes, verification in the Management Information System (MIS), and to meet bank requirements for collecting money.

Latest Utility Bills:

- Applicant (Must have)

- These bills are required for address verification and to assess your payment behavior.

Latest Photos:

- Applicant (Must have)

- The photos are needed for identification purposes.

Copy of Nikahnama:

- Applicant (Must have, but may be waived if not available after verification by other means)

- This document is required for identification purposes in case the wife’s CNIC is not in the name of the husband.

These documents play a crucial role in the application process for Akhuwat loans. They help establish your identity, verify your address, assess your payment behavior, and meet the necessary requirements. Make sure to have the required copies of CNICs, utility bills, photos, and a copy of the Nikahnama (if applicable) when applying for an Akhuwat loan.

Also visit: Naya Pakistan Housing Scheme 2023 | Mera Pakistan Mera Ghar

Akhuwat Loan Apply Online 2023

To apply online for an Akhuwat loan, follow these simple steps:

- Gather Documents: Collect the necessary documents such as identification proof, address proof, income details, and any other supporting documents.

- Visit Nearest Akhuwat Branch: Go to the nearest Akhuwat branch and bring all the documents with you.

- Submit Loan Application: Fill out the loan application form provided by the Akhuwat staff at the branch. Submit the form along with the required documents. There might be a small fee for the application process.

- Review of Documents: The Program Manager will carefully review your documents to ensure they are complete and accurate. They will check if you meet the eligibility criteria for the loan scheme.

- Application Processing: After the documents are reviewed, the Akhuwat team will process your application. They will assess your eligibility for the loan and evaluate your financial situation.

- Approval and Form Completion: If your application meets the requirements, you will be given an approved application form. The staff at the branch will assist you in completing the form and guide you through any additional requirements.

- Loan Approval: It usually takes around three to four weeks for the loan to be approved. During this time, the Akhuwat team will evaluate your application and determine the loan amount you are eligible for.

- Loan Disbursement: Once your loan is approved, a ceremony will be held at a mosque where the loan amount will be granted to you. This event is symbolic and is attended by Akhuwat representatives and community members.

FAQs:

What is an Akhuwat loan in Pakistan?

- Akhuwat loan is a program by Akhuwat Foundation called Akhuwat Islamic Microfinance (AIM). It provides interest-free loans to underprivileged individuals and families. The goal is to help them overcome poverty and create sustainable livelihoods. With over 800 branches in more than 400 cities across Pakistan, Akhuwat is the world’s largest interest-free microfinance program.

Who is the owner of the Akhuwat loan?

- Dr. Muhammad Amjad Saqib is the Founder and Executive Director of Akhuwat. He is a renowned social entrepreneur and development practitioner.

What is the maximum loan amount provided by Akhuwat Foundation?

- Akhuwat Foundation offers loans up to PKR 500,000/- to help poor families. These loans follow Islamic principles and aim to support families economically and socially. The repayment period is between 13 to 60 months.

Note: Please note that all the information provided in this post is obtained from official sources and other reliable resources. It is advised not to share your ID card number or mobile phone number here. Thank you for your understanding. We are solely focused on sharing information on ehsaas-porgrams.pk.

![Kamyab Jawan Program Gov PK Online Registration [2023-24]](https://ehsaas-programs.pk/wp-content/uploads/2023/07/2-4.jpg)

![Kashf Foundation Loan Apply Online [Interest Free] 2024](https://ehsaas-programs.pk/wp-content/uploads/2023/12/5-48-390x220.jpg)