Kamyab Jawan Program Loan Online Apply 2023 – PM Scheme

Kamyab Jawan Program Loan – Meezan Bank

Kamyab Jawan Program Loan Online Apply – Meezan Bank is working closely with the Pakistani government’s big ideas and is proudly introducing a special loan plan called “Kamyab Jawan.” This plan is made just for young folks who want to start or boost their own businesses. It’s designed to give important help to people who are eligible and have dreams of starting or improving their own businesses. If you meet the requirements, you can easily apply for this good loan offer using the special Kamyab Jawan website: www.kamyabjawan.gov.pk.

The Pakistani government sees that young people with dreams of starting businesses or owning small companies need help with money. So, they’ve started something cool called the “Prime Minister’s Kamyab Jawan – Youth Entrepreneurial Scheme (PMKJ – YES).” This plan aims to give affordable loans to young people. This way, they can either start up new businesses or make their existing small businesses even stronger. This smart move shows how much the government wants to help economic growth and new ideas.

A neat thing about this plan is that the government really wants to support both guys and gals. So, they’re setting aside a good 25% of these helpful loans just for young women who want to be entrepreneurs. This shows how serious the government is about making sure everyone gets a fair chance to succeed in business.

Eligibility Criteria:

If you’re a Pakistani citizen and have a National Identity Card (CNIC), and you’re between 21 and 45 years old, with a knack for business, you’re in luck! You can apply. If your business is about IT or E-Commerce, you can be as young as 18 years old.

For individuals and single business owners, the age rules apply. But if your business is a partnership or a company, at least one of the owners, partners, or directors should fall in the age range mentioned earlier.

This program is open to both brand-new small and medium-sized businesses (SMEs) and those that are already up and running. It doesn’t matter which field your business is in – whether it’s related to farming or any other sector – you’re eligible to get new funding.

Also check: Prime Minister Youth Loan Scheme 2023 Program Form Apply

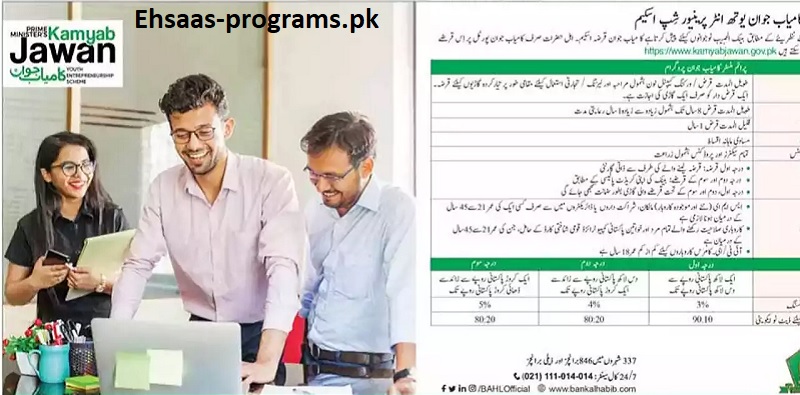

Different Levels of Financing

Depending on how much money you need for your business, there are different “tiers” or levels of financing available. Each tier has its own range of loan amounts, the interest rate you’ll be charged (which is also called the “Customer Profit Rate”), the kind of security needed, and the minimum amount of money you need to put in yourself. This last part is known as “Equity” or “Down Payment.”

Tier I: Small Boost

- If you’re looking to borrow between 100,000 to 1,000,000 Pakistani Rupees (PKR), you’ll be in Tier I. The interest rate is 3% per year. You won’t need any specific security for this, but you’ll need to invest at least 10% of the total amount yourself.

Tier II: Stepping Up

- If your business needs more, say, above 1,000,000 PKR up to 10,000,000 PKR, you’ll be in Tier II. The interest rate here is 4% per year. For this level, you’ll need something valuable to put up as security (this is called “collateral”). Also, you’ll need to invest at least 20% of the total amount yourself.

Tier III: Bigger Ventures

- For even bigger business plans, like needing over 10,000,000 PKR but up to 25,000,000 PKR, Tier III is the one. The interest rate for this tier is 5% per year. Similar to Tier II, you’ll need collateral and at least 20% of the amount as your own investment.

If you’re starting a brand-new business, you’ll have to put in some money upfront as a sign that you’re committed. This is called a “Down Payment.” It applies to financing methods like Musawammah and Murabaha.

Each tier offers different opportunities, and the amount you choose to go for will depend on how much your business needs and what you’re comfortable with. It’s essential to understand these tiers to make the best decision for your business.

Kamyab Jawan Program Loan Online Apply 2023

Here’s How to Apply for the Loan:

- Visit kamyabjawan.gov.pk/BankForm/newApplicantForm: To begin, go to the official government website. You can do this by clicking on the link provided that says “Click Here.”

Pick Meezan Bank:

- While you’re on the website, choose Meezan Bank as the bank you want to work with for the loan.

First Look:

- Once Meezan Bank gets your request, they will start by taking a first look at the details you shared.

- Checking Your Potential: The bank will figure out how good your business ideas are. They’ll do this by using their own rules and some specific things they look for.

Talk and Review:

- If your request seems good, they might want to talk to you and learn more. This depends on your own unique situation.

Making Sure It’s Right:

- The bank wants to be sure that everything you said is true. They have a strong, separate way to double-check this.

Yes or No:

- After looking at your situation and checking the rules, the bank will decide if they can give you the loan or not. Then, they’ll send you a text message to tell you what they decided.

Getting the Money:

- If you get a “yes,” the bank will give you the money you need. You can use this money to buy things for your business, like stuff you need or things to sell. And don’t forget, everything will be done the right way, following the rules of Shariah, which is how things work in Islam.

Remember, the whole idea of this process is to make sure the loan goes to the right people and is used in the right way. It’s like a step-by-step plan to help you and the bank both get the most out of this chance.

Also check: Kamyab Jawan Program Loan NBP Online Apply 2023-24

FAQs:

What is the Kamyab Jawan Loan Program by Meezan Bank?

- The Kamyab Jawan Loan Program is a special initiative by Meezan Bank in collaboration with the Government of Pakistan. It offers financial support to young entrepreneurs and small business owners who want to start new businesses or strengthen existing ones.

Who is eligible to apply for this loan?

- All citizens of Pakistan holding CNIC (National Identity Card), aged between 21 and 45 years, are eligible to apply. For IT/E-Commerce-related businesses, the lower age limit is 18 years. This eligibility applies to individual applicants and sole proprietors. For other business forms like partnerships and companies, at least one owner, partner, or director must fall within the specified age range.

How can I apply for the Kamyab Jawan Loan?

- To apply for the loan, visit the official Government portal and select Meezan Bank as your preferred bank. Once you provide the necessary information, Meezan Bank will begin the screening process.

How will I know if my loan application is approved or rejected?

- Meezan Bank will review your profile against the government’s scheme and the bank’s financing policy. If approved or rejected, you will receive an SMS notification on the phone number you provided.

Can female entrepreneurs apply for this loan?

- Absolutely, the program is committed to gender inclusivity. 25% of the financing is reserved for female entrepreneurs to promote diversity and inclusion.

Note: Please note that all the information provided in this post is obtained from official sources and other reliable resources. It is advised not to share your ID card number or mobile phone number here. Thank you for your understanding. We are solely focused on sharing information on ehsaas-porgrams.pk.