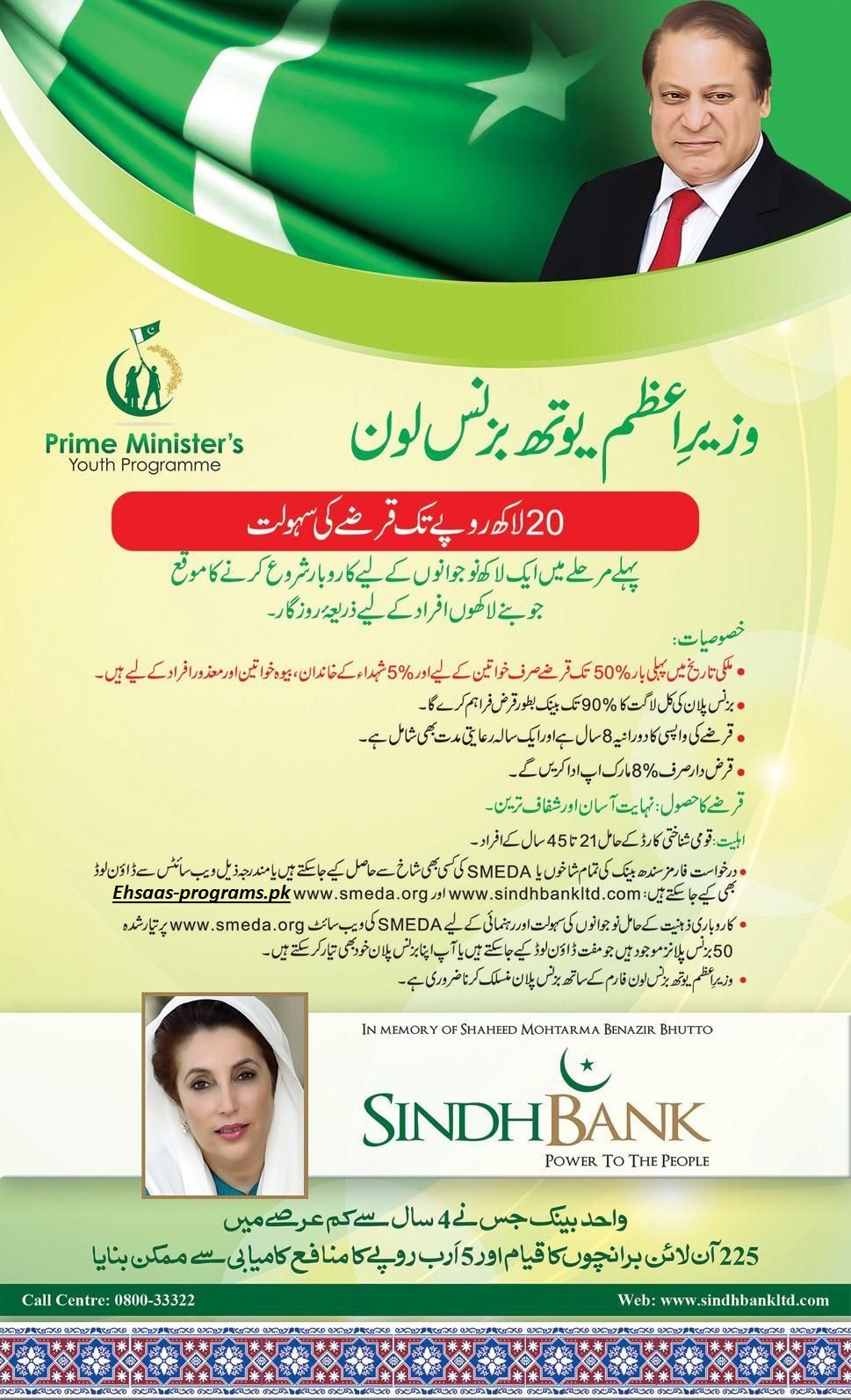

Prime Minister Youth Loan Scheme 2023 Online Apply Pakistan

Prime Minister Youth Loan Scheme 2023

The Prime Minister of Pakistan has introduced the Youth Loan Scheme to support young people in the country. The government understands the importance of the youth in shaping the future, and they want to provide financial help and opportunities for entrepreneurial endeavors. Since 68% of the population is made up of young individuals, it is crucial to prioritize their well-being and growth for the advancement of the nation.

The goal of the Youth Loan Scheme is to unlock the potential of young people who may not have the necessary resources and opportunities to make the most of their skills. This initiative focuses on creating facilities and support systems in various fields that cater to the specific needs of the youth.

By investing in the future of Pakistan’s youth, the government aims to empower them to succeed and contribute to the country’s progress and development. The Youth Loan Scheme recognizes the youth as the builders of the nation and aims to provide them with the essential resources and support they need to excel in their chosen fields.

Youth Loan Scheme Size

When it comes to the size of loans, they are categorized into three tiers, each representing a different range of loan amounts:

- Tier 2 (T2): This tier includes loans that are above Rs 0.5 million but do not exceed Rs 1.5 million.

- Tier 3 (T3): Loans falling into this tier are above Rs 1.5 million and go up to Rs 7.5 million.

Loan Types

There are different types of loans available for various purposes:

- Term Loans and Working Capital Loans: These loans are suitable for businesses to manage their day-to-day operations or fund specific projects. They can be used to buy inventory, pay employees, expand the business, and more. They may also offer financing options like Murabaha (an Islamic financing method) and leasing for machinery and locally manufactured commercial vehicles.

- Financing of Machinery and Locally Manufactured Vehicles: This loan type is specifically designed to help businesses acquire the machinery and vehicles they need for their operations. Normally, borrowers can obtain financing for one vehicle, but those involved in the food franchise and distribution business may be eligible for financing multiple vehicles.

- Civil Works Financing: For civil works, up to 65% of the total financing limit can be used. This funding is meant for construction projects, renovations, and other infrastructure-related expenses.

- Agriculture Loans: These loans are intended to support individuals involved in agricultural activities. They can be used for agricultural production and development purposes, providing assistance to farmers and others in the agriculture sector.

In conclusion, these loan options cater to a wide range of needs, from general business financing to specific sectors like agriculture. The specific terms and conditions of each loan type may vary based on the borrower’s circumstances.

Also visit: Kamyab Jawan Program Loan NBP Online Apply 2023-24

Loan Tenors

The duration of loans varies depending on the category:

- Tier 2 (T2) and Tier 3 (T3) Long-Term/Development Loans: For these types of loans, the repayment period can be up to 8 years. Additionally, borrowers may be granted a maximum grace period of up to one year before they start making regular loan payments.

- Working Capital/Production Loans and Murabaha under T2 and T3: The tenor, or duration, of these loans can be up to 5 years. Banks have the option to offer working capital/production loans where borrowers only need to pay the interest (markup) during the first 2 years. After that, both the principal amount and the interest will be paid over the next 3 years, resulting in a total repayment period of up to 5 years.

In summary, long-term/development loans have a maximum repayment period of 8 years, with a grace period of up to one year. Working capital/production loans and Murabaha under T2 and T3 can have a tenor of up to 5 years, with the possibility of paying only interest for the first 2 years and then both principal and interest for the remaining 3 years.

Eligibility Criteria for Prime Minister Youth Loan Scheme:

- Citizenship: You must be a citizen of Pakistan and have a valid Computerized National Identity Card (CNIC).

- Age: To be eligible, you should be between 21 and 45 years old. However, if you are starting an IT/E-commerce business, the minimum age requirement is 18 years. If you are an individual or sole proprietor in this field, you need to have at least completed matriculation or an equivalent level of education. For other types of businesses like partnerships or companies, only one of the owners, partners, or directors needs to be within the specified age range.

- Small and Medium Enterprises (SMEs): Both new startups and existing businesses owned by individuals within the specified age range are eligible for the program.

- Agriculture: For agricultural businesses, the classification of farmers will be based on the “Indicative Credit Limits & Eligible Items for Agriculture Financing 2020” guidelines issued by the State Bank of Pakistan (SBP). Please refer to the detailed discussion for further information on the specific criteria for agriculture financing. (In simple terms: If you are involved in agriculture, your eligibility will be determined based on specific guidelines provided by the State Bank of Pakistan regarding credit limits and eligible items for financing in the agricultural sector.)

Also visit: 5 Lakh Loan Without Interest in Pakistan 2023 Kamyab Program

Prime Minister Youth Loan Scheme 2023 Online Apply

To apply for the Prime Minister Youth Loan Scheme 2023 online, you can follow these simple steps:

- Visit the PMYP website dedicated to the Kamyab Pakistan Program.

- Look for the registration button or link on the website.

- Click on the registration button to access the online application form.

- Fill in the form by providing your CNIC (Computerized National Identity Card) number and phone number.

- Once you have entered the required information, submit the form.

- After submitting the form, you will receive a confirmation message.

- The confirmation message will provide updates on your registration status and inform you about any further steps you need to take.

By following these steps, you can easily apply for the Prime Minister Youth Loan Scheme 2023 online through the dedicated portal and take advantage of its various benefits.

Also visit: Kamyab Jawan Program Gov PK Online Registration [2023-24]

Online Application Form

The PM Youth Program (PMYP) Portal has introduced an online application form to ensure efficient monitoring. This form is available in both English and Urdu languages on the portal.

The main objective of the portal is to offer a centralized platform where applicants can directly apply to the relevant banks. The National Information Technology Board, which falls under the Ministry of IT and Telecommunication, will oversee and manage the portal.

Note: Please note that all the information provided in this post is obtained from official sources and other reliable resources. It is advised not to share your ID card number or mobile phone number here. Thank you for your understanding. We are solely focused on sharing information on ehsaas-porgrams.pk.

![Prime Minister Youth Loan Program Online Apply 2023 [Latest]](https://ehsaas-programs.pk/wp-content/uploads/2023/09/5-8-390x220.jpg)