NBP Loan Scheme for Government Employees 2024 – Online Apply

NBP Advance Salary Loan: Easy Financial Support for Government Employees

NBP Loan Scheme: If you’re working for the government or in a private company and need some extra money for different expenses, here’s some good news! The National Bank has introduced a program called Advance Salary Loan, and it’s available for government employees, including those in the Pakistan army, and even for contractual workers. You can apply for this loan online or by filling out a form on the National Bank’s official website, www.nbp.com.pk.

This loan program is for both Federal and provincial government workers, but you have to meet certain criteria set by the National Bank to qualify. It’s interesting to know that people with other sources of income can also apply, as long as they meet the National Bank of Pakistan’s requirements.

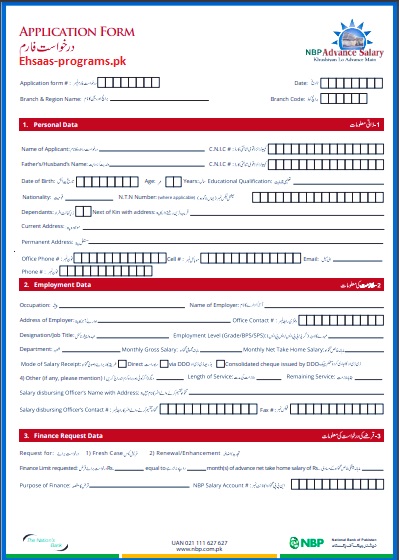

To apply for the Advance Salary Loan, you can easily find the application form on the National Bank’s official website. The online process makes it convenient for you to apply from your home or workplace, adding an extra layer of accessibility.

It’s worth noting that this loan program is open to a wide range of government employees, including those in the Pakistan Army, and on contractual terms. The National Bank is providing this financial help to ease the money-related challenges that people working in different sectors might face.

This effort not only encourages more people to access financial support but also makes the application process simpler for those who meet the criteria. So, if you qualify, don’t miss the chance to check out the Advance Salary Loan program from the National Bank of Pakistan.

Also visit: Student Loan in Pakistan [National Bank] NBP Scheme 2024 Apply

Eligibility Criteria for the NBP Loan Scheme:

For Government Employees:

Employee Type:

- Permanent government employees

- Those working in Federal, provisional, semi-government, and autonomous departments

Salary Disbursement:

- Candidates receiving salaries from the National Bank of Pakistan

Loan Limit:

- Maximum loan amount: Rs. 300,000/- (3 Million)

Loan Repayment:

- Repayment period: 4 years (48 months)

- Lowest interest rate or markup rate: 26.5% fixed per annum

Age Limit:

- Maximum age at the time of loan application: 59 years and 6 months

Also visit: Ehsaas Bachat Bank Account 2023-24 Open – Complete Method

For Contractual Employees:

Employee Type:

- Contractual employees of federal, provisional, semi-government, and autonomous organizations

National Bank account holders

Loan Amount:

- Maximum loan amount: Rs. 2,000,000/- (2 Million)

Loan Repayment:

- Repayment period: 4 years (48 months)

Age Limit:

- Maximum age at the time of loan application: 55 years

Interest Rate:

- The lowest interest rate or markup rate: 28% fixed per annum

For Applicants with Other Sources of Income:

Verified Rental Income:

- Copy of proof of ownership (e.g., Title documents)

Verified Agriculture Income:

- Copy of proof of ownership (e.g., Title documents)

Verified Income from Investments (TDRs/National Saving Certificate/Premium Prize Bond):

- Copy of proof of savings (e.g., TDR/National Saving Certificate/Premium Prize Bond – Registered)

- Bank account statement reflecting savings income for the last 6 months

- Copy of Income tax return showing the investments in TDR/NSC/PPB

Also visit: Prime Minister Loan Scheme 2024 without Interest Online Apply

Documents Required for NBP Loan:

To apply for the NBP Loan Scheme for Government employees, the application form must be accompanied by the following documents:

- Last three months’ salary slips or salary certificates.

- Employer undertaking.

- Copies of CNIC (Computerized National Identity Cards) of the applicant and two references, duly attested by the concerned NBP branch or Gazetted Officer.

- Copies of Employee ID cards of the applicant and references, attested by the NBP branch or Gazetted Officer where applicable.

- Customer undertaking on Rs.20/- stamp paper (Bond Paper).

Also visit: Akhuwat Loan Apply Online 2023-24 Interest-Free Loan Scheme

How to Apply NBP Loan Scheme for Government Employees?

To apply for the NBP Loan Scheme for Government employees, follow these steps:

Download the Application Form:

- Visit the National Bank of Pakistan’s official website and navigate to the section related to the Advance Salary Loan Scheme. Locate the application form in PDF format, which is generally available for download on the website. You can find the specific form at the following link: NBP Loan Scheme Application Form.

Complete the Application Form:

- Once downloaded, carefully fill out the application form with accurate and up-to-date information. Ensure that all required fields are properly filled, and follow any instructions provided on the form.

Gather Required Documents:

- Collect the necessary documents as specified in the application form. This typically includes the last three months’ salary slips or salary certificates, an employer undertaking, copies of CNICs (Computerized National Identity Cards) for the applicant, and two references, as well as copies of employee ID cards, if applicable. Additionally, prepare the customer undertaking on a Rs.20/- stamp paper.

Document Attestation:

- Ensure that all relevant documents, especially copies of CNICs and employee ID cards, are attested by the concerned NBP branch or a Gazetted Officer. This attestation serves as a verification of the authenticity of the provided documents.

Submit the Application:

- Visit the National Bank of Pakistan branch where you receive your salary. Submit the completed application form along with the required documents to the designated officer or department handling loan applications. Be prepared to provide any additional information or clarification if requested during the submission process.

Follow-Up:

- After submission, inquire about the processing timeline for your application. Banks typically take some time to review and approve loan applications. Stay in touch with the bank for any updates or additional requirements.

By following these steps, you can initiate the application process for the NBP Loan Scheme for Government employees and work towards obtaining an advance salary loan through the National Bank of Pakistan.

Note: Please note that all the information provided in this post is obtained from official sources and other reliable resources. It is advised not to share your ID card number or mobile phone number here. Thank you for your understanding. We are solely focused on sharing information on ehsaas-porgrams.pk.

![Mazdoor Card Online Apply in Pakistan [2023-24] - مزدور کارڈ](https://ehsaas-programs.pk/wp-content/uploads/2023/07/2-41.jpg)