PM Youth Loan Scheme 2024 Online Apply – Last Date

PM Youth Loan Scheme 2024

PM Youth Loan Scheme 2024 Online Apply – In 2024, Pakistan has a special plan known as the PM Youth Loan Scheme. This program aims to assist young individuals who want to work but lack sufficient funds. The government offers loans with a small additional amount (called “markup”) through specific banks that follow Islamic rules, known as SMSE banks. A notable advantage is the loan’s flexibility, allowing some rules to be adjusted to fit the borrower’s needs.

Before receiving these loans, there are specific rules and conditions set by the Pakistani government. Applying for the loan is done online by visiting the official government website and completing a form. This online process adds convenience for applicants.

In addition to loans, the government also provides laptops to young people who have pursued education and wish to continue learning. Anyone in Pakistan possessing an ID card and being at least 21 years old is eligible for the Prime Minister Youth Loan Scheme, especially if they have an interest in entrepreneurship or work.

To participate, individuals must be at least 18 years old. For those aspiring to work in IT or e-commerce (online selling), a certain level of education is necessary, such as passing a high school exam. Landlords are required to be of legal drinking age.

Young people who own small or medium-sized businesses, whether new or established, can also qualify, following the age limits mentioned earlier. The scheme also takes into consideration farmers’ situations, connecting to Agriculture Financing 2020.

For young individuals in Pakistan who desire to work but lack the initial funds, the Prime Minister Youth Loan Scheme presents an opportunity. Ensuring compliance with the requirements and following application steps is crucial to benefit from this program.

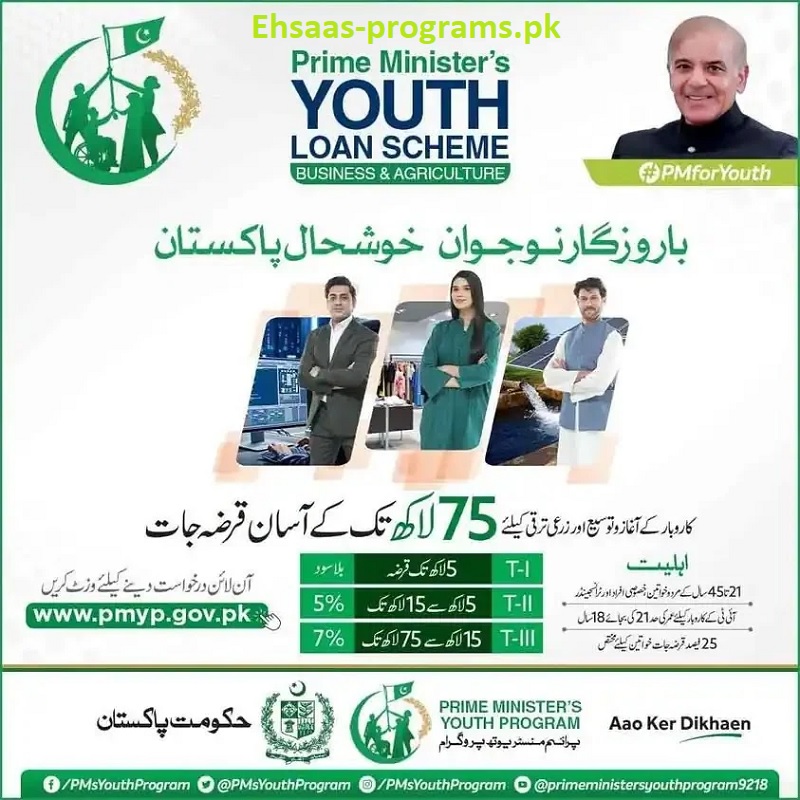

PM Youth Loan 2024 Categories:

The Prime Minister Loan Scheme offers different loan categories:

- Tier 1: Loans are available from 0.5 million PKR with no interest added (0% markup).

- Tier 2: Loans range from above 0.5 million to 1.5 million PKR with a small additional fee (5% markup).

- Tier 3: Loans cover amounts above 1.5 million up to 7.5 million PKR with a slightly higher fee (7% markup).

When you apply for the loan, it takes about 45 days for the application to be processed. This scheme provides various options to accommodate different funding needs and aims to support individuals at various stages of business development.

Also check: PM Laptop Scheme 2024 Online Registration – Complete Method

Required Documents for PM Youth loan Scheme Online Registration:

To register for the PM Youth Loan scheme, you’ll need these documents:

- A picture like a passport photo.

- Scans of the back and front of your national ID card.

- Your latest education certificates: High School, Middle School, Bachelors, Masters, Ph.D., etc.

- If you have a business, a reference letter from the relevant Chamber, Trade Organization, or Union for the loan.

- If you’ve worked before, any certificates showing your experience.

- If needed, a license or registration from a trade group.

Before you start, make sure you have these documents and information ready. They’re important to begin your application.

Also check: Youth Skill Development Program Loan 2024 Online Apply Pakistan

PM Youth Loan Scheme Eligibility:

The PM Loan scheme has specific conditions for eligibility. To qualify, you need to be aged 21 to 45 and capable of managing a business. For those interested in IT/E-commerce, the minimum age is 18, with at least a Matriculation or equivalent education needed. This applies to sole proprietors and qualified individuals beyond the legal age limit.

This opportunity is open to all Pakistani citizens with valid CNICs. However, only one owner, partner, or director of any business, be it a partnership or corporation, needs to fulfill the age criteria.

A noteworthy aspect is that 25% of these loans are reserved for women borrowers, aiming to promote their involvement. The scheme aims to assist individuals who meet these criteria, empowering them to initiate businesses and contribute to the economy.

The Prime Minister’s Youth Business Loan Scheme is designed to provide funds to young business owners in Pakistan looking to start or expand their ventures. To be eligible:

- You should be aged between 21 and 45.

- You must hold Pakistani citizenship.

- You need a valid National Identity Card.

- Your business idea should create jobs and contribute to the economy.

If you meet these criteria, follow these steps to apply:

PM Youth Loan Scheme 2024 Online Apply

To apply for the PM Youth Loan Scheme 2024, you can easily use the online process. The first step is to fill out the application form for the Prime Minister’s Youth Business Loan. You can access this form using the following link:

https://www.pmyp.gov.pk/BankForm/newApplicantForm

Before you start the application, make sure you have scanned copies or clear pictures of the required documents ready:

- A passport-sized photo.

- Both sides of your CNIC (front and back).

- Your most recent education certificates, such as Matric, Intermediate, Bachelor, Masters, Ph.D., if applicable.

- For existing businesses, gather certificates like experience records, licenses, and proof of registration with trade organizations. Sometimes, you might need a recommendation letter from the relevant chamber, trade organization, or union.

- Your current address and name’s electricity bill, including the consumer ID (the section with your ID).

- If relevant, the registration number of any vehicle registered under your name.

- Two references who are not family members. Make sure to have their names, CNICs, and mobile numbers.

For those starting a new business, prepare an estimate of your monthly business revenue, variable costs, household expenses, and any other potential income sources. If you already have a business, provide accurate figures for your actual monthly business income, expenses, household costs, and any additional sources of income.

This detailed information ensures a smooth application process for the PM Youth Loan Scheme. Having these documents and data ready will help you complete the application efficiently and increase your chances of success.

Also check: Kamyab Jawan Program Application Form Online Apply 2024

FAQs:

Can I apply if I’m over 45 years old?

- Unfortunately, the scheme is only available for individuals aged 21 to 45.

Do I need collateral for all loan amounts?

- Loans up to PKR 1,000,000 don’t need collateral. For higher amounts, collateral might be needed.

How long does the loan application take to process?

- The processing time varies, but usually, it takes a few weeks for your application to be reviewed and approved.

Is a business plan necessary to apply?

- Yes, having a clear business plan is a must when applying for this scheme.

Are there extra fees or charges for the loan?

- No, besides the subsidized interest rate, there are no extra fees or charges involved.

Note: Please note that all the information provided in this post is obtained from official sources and other reliable resources. It is advised not to share your ID card number or mobile phone number here. Thank you for your understanding. We are solely focused on sharing information on ehsaas-porgrams.pk.

![Fori Loan in Pakistan [10K to 30K] Updated 2024](https://ehsaas-programs.pk/wp-content/uploads/2023/12/5-10-390x220.jpg)