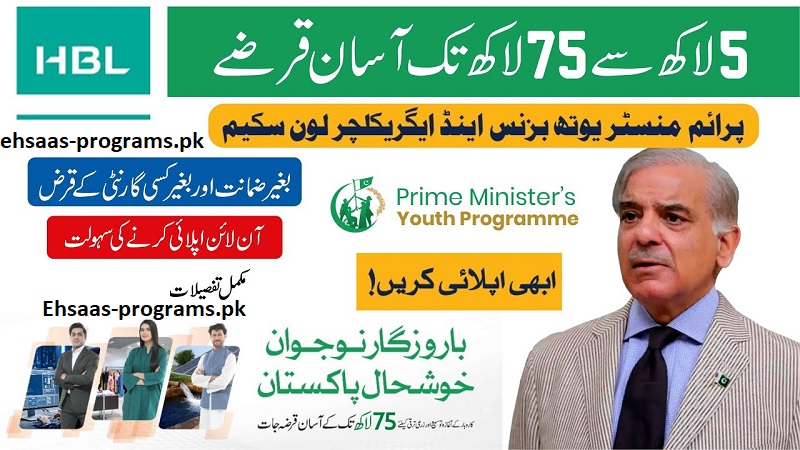

PM Youth Loan Scheme Business and Agriculture 2023 Apply

PM Youth Business and Agriculture Loan Scheme

PM Youth Loan Scheme – The Prime Minister of Pakistan is doing something really good to help young people and farmers in Pakistan. He has started two plans in Islamabad called the Youth Business and Agricultural Loan Schemes. These plans want to inspire and help young people to become successful business owners and help farmers.

The main goal of these plans is to make it easier for young people and farmers to get the money they need for their businesses. The government has started a program called the Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB & ALS) to give loans at a low cost. These loans can help with short-term and long-term needs. This money is given to help young people start or grow their businesses. It’s also meant to make sure women have the same chance to start businesses.

The Youth Business Loan Scheme is an exciting plan that wants to help young people start and grow their own businesses. They can get soft loans with good terms, so they don’t have to pay back a lot of money quickly. This helps young people follow their dreams of starting a business and also creates jobs, which makes the country’s economy better.

The Agricultural Loan Scheme is for farmers and businesses in farming. Farming is very important for Pakistan’s economy. With these loans, farmers and farming businesses can buy new equipment and use better technology to make more crops and money. This also helps make sure there is enough food for everyone in Pakistan and keeps the economy strong.

Both plans want to make it easier for young people and farmers to get money to grow their businesses. By giving soft loans, the government is making a place where new ideas and businesses can succeed. This is all part of Prime Minister Youth Business Loan Shehbaz Sharif’s plan to help young people and make the country’s economy stronger.

PM Youth Loan Scheme Details:

How Much Money You Can Get

The money you can get is divided into different levels:

- Tier 2 (T2): This is for loans above Rs.0.5 million and up to Rs.1.5 million.

- Tier 3 (T3): This is for loans above Rs.1.5 million and up to Rs.7.5 million.

Types of Financing

You can use this money for different things like buying machines for your business, covering your everyday business expenses, or even for construction work if you need it. If you’re in agriculture, you can use it for production and development.

How Much You Have to Pay Back

The amount you have to pay back depends on which tier you are in:

- T2: You have to pay 5% interest every year.

- T3: You have to pay 7% interest every year.

Keeping Your Money Safe

For T2 loans, you don’t need to give any security other than your promise that you will pay it back. But for T3 loans, you need to follow the rules set by the bank.

How Much You Need to Contribute

If you’re starting a new business, you need to put in some of your own money. Here’s how it works:

T2: You need to put in 10% of the money, and the rest comes from the loan.

T3: You need to put in 20% of the money, and the loan covers the rest.

If you already have a business, you don’t need to put in your own money.

How Long Do You Have to Pay Back

You get some time to pay back the money. For T2 and T3 loans, you have up to 8 years to pay it back, with an extra year if you need more time at the start.

Fees and Costs

When you apply for a loan, you need to pay a processing fee of Rs.100. There might be other charges too, but they depend on your specific situation.

Where You Can Get the Money

You can get this money all over Pakistan. It’s available to people in different parts of the country.

Also check: Prime Minister Youth Business Loan Apply Online in Pakistan

Eligibility Criteria

- Age Requirement: If you’re a Pakistani citizen and you have a Computerized National Identity Card (CNIC), you can apply if you’re between 21 and 45 years old. But if you’re interested in IT and E-commerce, you can apply at just 18 years old.

- Education: You need at least a matriculation or similar level of education to be eligible.

- Business Types: If you’re an individual starting your own business or a sole owner, you need to meet the age requirements. For other types of businesses like partnerships and companies, at least one of the owners, partners, or directors should be in the right age group.

- Small and Medium Enterprises (SMEs): If you’re starting a new business or already have a small or medium-sized enterprise and you’re between 21 and 45 years old, you can apply for these loans.

- Agriculture: If you’re a farmer working in agriculture, you can also apply, following the rules set by the State Bank of Pakistan.

Also check: PM Youth Program Loan Scheme 2023 Complete Details – Apply

PM Youth Loan Application and Required Documents:

When you want to get a loan through these schemes, you’ll need to follow a process and provide certain documents to the bank. Here’s what you need to know:

- Online Loan Application: The first step is to fill out a loan application online. This is where you provide basic information about yourself and your business plans. It’s like telling the bank why you need the money and how you plan to use it.

- Financials and Cash Flow Projections: You’ll need to show the bank your financial information. This includes things like how much money your business makes and how much it spends. You’ll also need to create cash flow projections, which are like predictions of how your money will come in and go out in the future. This helps the bank understand if your business is financially healthy and if you can pay back the loan.

- Bank Statement: Your bank statement shows the history of your business’s financial transactions. It helps the bank get a clear picture of how you manage your money.

- Feasibility/Business Plan: A feasibility or business plan outlines your business idea in detail. It includes information about your products or services, your target market, competition, and how you plan to operate and grow your business. This plan helps the bank assess the viability of your business and your repayment ability.

- Guarantor Documents (if required): Depending on the bank’s policies, you might need someone to guarantee that they will pay back the loan if you can’t. In this case, the guarantor will need to provide their documents as well.

- Collateral Documents (if applicable): If the bank asks for collateral, you’ll need to provide documents related to the assets you’re offering as security for the loan. Collateral can include property, equipment, or other valuable assets.

These papers are important because the bank wants to make sure you have a good plan for your business and that you can pay back the loan. So, when you’re ready to ask for a loan under these plans, gather these papers and give them to the bank. It’s a big step in getting the money you need to start or grow your business.

Also check: PM Laptop Scheme 2023 Online Registration – Complete Method

How to Apply for the PM Youth Loan Scheme?

If you want to get a loan through these programs, it’s not too hard. Here’s how:

- Go to the PM Youth Portal: First, you need to visit the PM Youth Portal. This is a website that helps you apply for a loan. It also keeps track of everything.

- Fill Out the Form: On the PM Youth Portal, you’ll see a form you need to fill out. You can do it in English or Urdu, whichever you prefer. This form asks questions about you and your business plans. It’s like telling them why you need the money and what you’ll do with it.

- Provide Required Information: The form asks for important stuff like your business idea, how much money you want, how you’ll use it, and how your money situation looks.

- Submit the Application: After filling out the form, you send it through the PM Youth Portal. Make sure everything you wrote is correct before you send it.

- Wait for an Answer: Now, the bank or the people in charge will look at your form. They’ll decide if they can give you the loan. They check if your business plan makes sense and if you can pay back the money.

- Give More Info (if needed): Sometimes they might need more papers or explanations. If they ask, be quick in giving them what they need.

- Get Approved: If they say yes, they’ll tell you and explain the rules for the loan.

- Use the Money: Once they approve your loan, you can use the money for your business plans, whether it’s starting something new or making what you have better.

- Repayment: Remember, you have to give the money back according to the rules they tell you. Paying on time is really important.

By doing all these steps and using the PM Youth Portal, you can ask for a loan in an easy way. The online form makes it simple to share what they need to know. It’s a great chance for young people in Pakistan to get money for their business dreams.

Note: Please note that all the information provided in this post is obtained from official sources and other reliable resources. It is advised not to share your ID card number or mobile phone number here. Thank you for your understanding. We are solely focused on sharing information on ehsaas-porgrams.pk.

![Kashf Foundation Loan Apply Online [Interest Free] 2024](https://ehsaas-programs.pk/wp-content/uploads/2023/12/5-48-390x220.jpg)